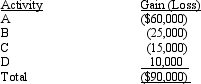

Seth has four passive activities.The following income and losses are generated in the current year.

How much of the $90,000 net passive loss can Seth deduct this year? Calculate the suspended losses (by activity).

How much of the $90,000 net passive loss can Seth deduct this year? Calculate the suspended losses (by activity).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Joyce, an attorney, earns $100,000 from her

Q81: Explain how a taxpayer's at-risk amount in

Q85: Tangerine Corporation,a closely held (non-personal service)C corporation,earns

Q86: Caroline sells a rental house for $320,000

Q87: In 2011,Emily invests $100,000 in a limited

Q88: Barb borrowed $100,000 to acquire a parcel

Q90: Ken has a $40,000 loss from an

Q91: In the current year, Lucile, who has

Q93: Samantha invested $75,000 in a passive activity

Q96: Green, Inc., a closely held personal service

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents