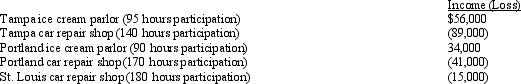

Lloyd,a life insurance salesman,earns a $400,000 salary in the current year.As he works only 30 hours per week in this job,he has time to participate in several other businesses.He owns an ice cream parlor and a car repair shop in Tampa.He also owns an ice cream parlor and a car repair shop in Portland and a car repair shop in St.Louis.A preliminary analysis on December 1 of the current year shows projected income and losses for the various businesses as follows:

Lloyd has full-time employees at each of the five businesses listed above.Review all possible groupings for Lloyd's activities.Which grouping method and other strategies should Lloyd consider that will provide the greatest tax advantage?

Lloyd has full-time employees at each of the five businesses listed above.Review all possible groupings for Lloyd's activities.Which grouping method and other strategies should Lloyd consider that will provide the greatest tax advantage?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Roxanne, who is single, has $125,000 of

Q74: Jed spends 32 hours a week, 50

Q75: Emily earns a salary of $150,000, and

Q78: Skeeter invests in vacant land for the

Q79: Match the treatment for the following types

Q85: Sam, who earns a salary of $400,000,

Q85: Tangerine Corporation,a closely held (non-personal service)C corporation,earns

Q86: Caroline sells a rental house for $320,000

Q98: During the year, James performs the following

Q100: List the taxpayers that are subject to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents