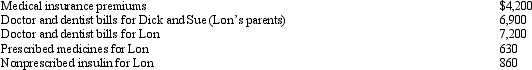

Lon is employed as an accountant.For calendar year 2011,he had AGI of $120,000 and paid the following medical expenses:  Dick and Sue would qualify as Lon's dependents except that they file a joint return.Lon's medical insurance policy does not cover them.Lon filed a claim for $3,800 of his own expenses with his insurance company in November 2011 and received the reimbursement in January 2012.What is Lon's maximum allowable medical expense deduction for 2011?

Dick and Sue would qualify as Lon's dependents except that they file a joint return.Lon's medical insurance policy does not cover them.Lon filed a claim for $3,800 of his own expenses with his insurance company in November 2011 and received the reimbursement in January 2012.What is Lon's maximum allowable medical expense deduction for 2011?

A) $5,130.

B) $10,790.

C) $12,730.

D) $19,790.

E) None of the above.

Correct Answer:

Verified

Q41: Dwayne contributed stock worth $17,000 to a

Q43: In 2011,Dorothy drove 500 miles to volunteer

Q45: The phaseout of certain itemized deductions has

Q46: Any capital asset donated to a public

Q49: During the year, Victor spent $300 on

Q49: Liz,who is single,travels frequently on business.Art,Liz's 84-year-old

Q50: In the year of her death, Maria

Q51: Jerry pays $5,000 tuition to a parochial

Q51: Bjorn contributed a sculpture to the Minnesota

Q55: Nancy had an accident while skiing on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents