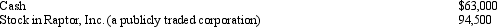

During 2011,Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :  Ralph acquired the stock in Raptor,Inc.,as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for 2011 is $189,000.What is Ralph's charitable contribution deduction for 2011?

Ralph acquired the stock in Raptor,Inc.,as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for 2011 is $189,000.What is Ralph's charitable contribution deduction for 2011?

A) $56,700.

B) $63,000.

C) $94,500.

D) $157,500.

E) None of the above.

Correct Answer:

Verified

Q69: Diego, who is single and lives alone,

Q77: During the current year,Vijay,a self-employed individual,paid the

Q78: Wayne developed heart problems and was unable

Q80: Marilyn,Ed's daughter who would otherwise qualify as

Q81: Brian,a self-employed individual,pays state income tax payments

Q84: During 2011,Clara,who is self-employed,paid $500 per month

Q85: Freda,who has AGI of $100,000 in 2011,contributes

Q86: In 2004,Ross,who is single,purchased a personal residence

Q87: Virginia had AGI of $100,000 in 2011.She

Q97: Pat died this year.Before she died, Pat

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents