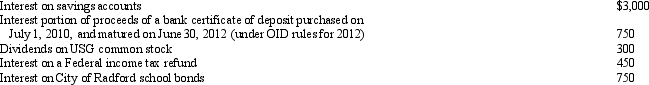

George,an unmarried cash basis taxpayer,received the following amounts during 2012:  What amount should George report as gross income from dividends and interest for 2012?

What amount should George report as gross income from dividends and interest for 2012?

A) $4,050.

B) $4,500.

C) $4,800.

D) $6,000.

E) None of the above.

Correct Answer:

Verified

Q90: Flora Company owed $95,000, a debt incurred

Q93: The exclusion of interest on educational savings

Q95: Beverly died during the current year. At

Q96: Harold bought land from Jewel for $150,000.Harold

Q98: Denny was neither bankrupt nor insolvent but

Q100: Barbara was injured in an automobile accident.She

Q101: The CEO of Cirtronics Inc., discovered that

Q102: Sally and Ed each own property with

Q104: What are the tax problems associated with

Q108: Gull Corporation was undergoing reorganization under the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents