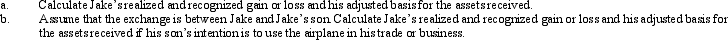

Jake exchanges an airplane used in his business for a smaller airplane to be used in his business.His adjusted basis for the airplane is $325,000 and the fair market value is $310,000.The fair market value of the smaller airplane is $300,000.In addition,Jake receives cash of $10,000.

Correct Answer:

Verified

Q28: Janet, age 68, sells her principal residence

Q101: For each of the following involuntary conversions,determine

Q105: Samuel's hotel is condemned by the City

Q108: Mandy and Greta form Tan,Inc.,by transferring the

Q108: Use the following data to determine the

Q192: Which of the following statements is correct

Q199: Eric and Faye, who are married, jointly

Q234: What requirements must be satisfied to receive

Q236: Discuss the relationship between the postponement of

Q239: What kinds of property do not qualify

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents