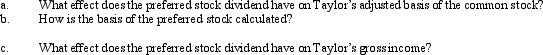

Taylor owns common stock in Taupe,Inc.,with an adjusted basis of $100,000.She receives a preferred stock dividend which is nontaxable.

Correct Answer:

Verified

Q36: Lynn transfers her personal use automobile to

Q46: Lois received nontaxable stock rights with a

Q74: Alice is terminally ill and does not

Q138: Ed and Cheryl have been married for

Q209: Joseph converts a building (adjusted basis of

Q212: Discuss the effect of a liability assumption

Q231: Why is it generally undesirable to pass

Q232: Explain how the sale of investment property

Q241: What effect does a deductible casualty loss

Q252: Define a bargain purchase of property and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents