Gwen went to Paris on business.While there,she spent 60% of the time on business and 40% on vacation.How much of the air fare of $4,000 can she deduct based on the following assumptions:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q110: Jacob is a landscape architect who works

Q115: If a business retains someone to provide

Q115: Elsie lives and works in Detroit. She

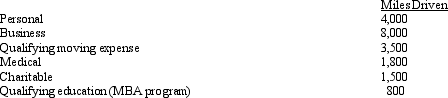

Q116: Rod uses his automobile for both business

Q118: For the current year,Horton was employed as

Q119: Brian makes gifts as follows:

Q121: Discuss the 2%-of-AGI floor and the 50%

Q122: In connection with the office in the

Q125: In terms of income tax treatment, what

Q139: Cathy takes five key clients to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents