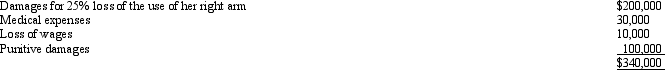

Barbara was injured in an automobile accident.She has threatened to file a suit against the other party involved in the accident and has proposed the following settlement:

The defendant's insurance company is reluctant to pay punitive damages.Also,the company disputes the amount of her loss of wages amount.Instead,the company offers to pay her $300,000 for damages to her arm and $30,000 medical expenses.Assuming Barbara is in the 35% marginal tax bracket,will her after-tax proceeds from accepting the offer be equal to what she considers to be her actual damages (listed above)?

The defendant's insurance company is reluctant to pay punitive damages.Also,the company disputes the amount of her loss of wages amount.Instead,the company offers to pay her $300,000 for damages to her arm and $30,000 medical expenses.Assuming Barbara is in the 35% marginal tax bracket,will her after-tax proceeds from accepting the offer be equal to what she considers to be her actual damages (listed above)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Louise works in a foreign branch of

Q84: Tonya is a cash basis taxpayer.In 2012,

Q88: In December 2012, Todd, a cash basis

Q93: The exclusion of interest on educational savings

Q96: Harold bought land from Jewel for $150,000.Harold

Q96: Sandy is married,files a joint return,and expects

Q97: Stuart owns 300 shares of Turquoise Corporation

Q98: Denny was neither bankrupt nor insolvent but

Q99: Assuming a taxpayer qualifies for the exclusion

Q100: On January 1, 2002, Cardinal Corporation issued

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents