Roxy,Inc.,grants 1,000 NQSO to an employee,Carol,entitling her to purchase Roxy stock at $10 per share (the current price of the stock).Roxy simultaneously grants 1,000 ISOs to another employee,Donna,entitling her to buy 1,000 shares of Roxy at $10 per share over a two-year period.One year later,2012,the stock has risen to $20 per share,and Carol and Donna both exercise their options in full,receiving stock not subject to an SRF.

Correct Answer:

Verified

Q64: What statement is false with respect to

Q84: Yvonne exercises incentive stock options (ISOs)for 100

Q85: What is a highly compensated employee?

Q85: Under a nonqualified stock option (NQSO)plan which

Q87: Yvonne exercises incentive stock options (ISOs)for 100

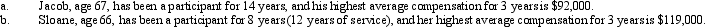

Q90: Determine the maximum annual benefits payable to

Q91: Which would not be considered an advantage

Q92: What is a defined contribution plan?

Q92: A qualified pension and profit sharing plan

Q96: In order to postpone income tax obligations

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents