Brown Corporation had consistently reported its income by the cash method.The corporation should have used the accrual method because inventories are material to the business.In 2012,Brown timely filed a request to change to the accrual method.At the beginning of 2012,Brown had accounts receivable of $90,000.Also,Brown had merchandise on hand with a cost of $120,000 and accounts payable for merchandise of $37,500.The accounts receivable,inventory,and accounts payable balance per books were zero.Determine the adjustment to income due to the change in accounting method and the amount that is allocated to 2012.

Adjustment due to the change:

The change is from a clearly incorrect method to a correct method.Therefore,the positive adjustment must be spread over four years.The company must add $43,125 ($172,500 divided by 4)to 2012 income.

The change is from a clearly incorrect method to a correct method.Therefore,the positive adjustment must be spread over four years.The company must add $43,125 ($172,500 divided by 4)to 2012 income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: Camelia Company is a large commercial real

Q66: In the case of a small home

Q75: The Yellow Equipment Company, an accrual basis

Q90: In 2012,George used the FIFO lower of

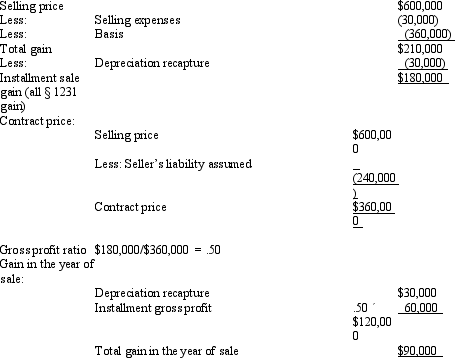

Q91: Ramon sold land in 2012 with a

Q94: Crow Corporation has used the LIFO inventory

Q97: A manufacturer must capitalize the following costs

Q98: The use of the LIFO inventory method

Q99: The Multi Department store takes physical inventories

Q100: In the case of a change from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents