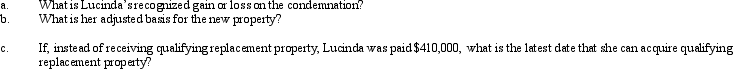

Lucinda,a calendar year taxpayer,owned a rental property with an adjusted basis of $312,000 in a major coastal city.Her property was condemned by the city government on October 12,2012.In order to build a convention center,Lucinda eventually received qualified replacement property from the city government on March 9,2013.This new property has a fair market value of $410,000.

Correct Answer:

Verified

Q23: Katrina, age 58, rented (as a tenant)

Q27: After 5 years of marriage, Dave and

Q32: Evelyn's office building is destroyed by fire

Q100: Sammy exchanges equipment used in his business

Q104: Jake exchanges an airplane used in his

Q106: For each of the following involuntary conversions,determine

Q107: Eunice Jean exchanges land held for investment

Q108: Mandy and Greta form Tan,Inc.,by transferring the

Q229: Discuss the logic for mandatory deferral of

Q239: What kinds of property do not qualify

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents