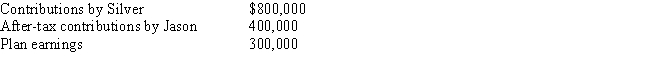

At the time of his death,Jason was a participant in Silver Corporation's qualified pension plan and group term life insurance.The balance of the survivorship feature in his pension plan is:

The term insurance has a maturity value of $100,000.All amounts are paid to Pam,Jason's daughter.One result of these transactions is:

A) Pam must pay income tax on $300,000.

B) Pam must pay income tax on $1,100,000.

C) Jason's gross estate must include $1,200,000.

D) Jason's gross estate must include $1,500,000.

Correct Answer:

Verified

Q79: The Federal gift tax does not include

Q80: At the time of his death,Tom owned

Q80: Concerning the election to split gifts, which

Q81: Andrea dies on April 30.Which,if any,of the

Q82: Concerning the Federal estate tax deduction for

Q83: At the time of her death on

Q86: Matt and Patricia are husband and wife

Q87: Concerning the Federal estate tax deduction for

Q88: At the time of his death,Norton was

Q127: Calvin's will passes $800,000 of cash to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents