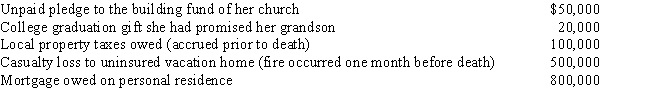

At the time of her death,Amber owns property worth $5,000,000.Other information regarding her affairs is as follows.

All of these items (except the casualty loss) were paid by her estate,and none were deducted on Form 1041 (income tax return of the estate).What is Amber's taxable estate?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Classify each of the following statements:

-Hector transfers

Q90: Classify each of the following statements:

-Under a

Q97: Classify each of the following statements:

-Under her

Q112: At the time of Clint's death,part of

Q114: At the time of her death on

Q116: Classify each statement appearing below.

a. No taxable

Q118: At the time of her death,Sophia was

Q119: At the time of his death on

Q121: Lily pays for her grandson's college expenses.Under

Q142: Waldo is his mother's sole heir and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents