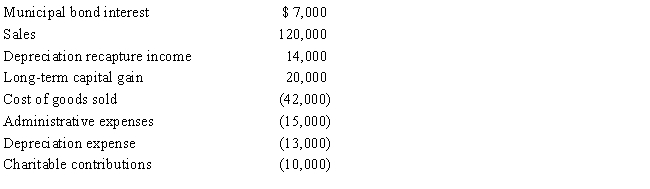

Estella,Inc.,a calendar year S corporation,incurred the following items during the tax year.

Calculate Estella's nonseparately computed income.

Correct Answer:

Verified

Q102: On December 31, Erica Sumners owns one

Q108: An S corporation's LIFO recapture amount equals

Q109: An S corporation recognizes a on any

Q117: Advise your client how income, expenses, gain,

Q132: Gene Grams is a 45% owner of

Q134: Alomar,a cash basis S corporation in Orlando,Florida,holds

Q135: You are a 60% owner of an

Q137: The § 1202 exclusion of _ on

Q138: Pepper,Inc.,an S corporation in Norfolk,Virginia,has revenues of

Q141: This year,Sammy Joseph,the sole shareholder of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents