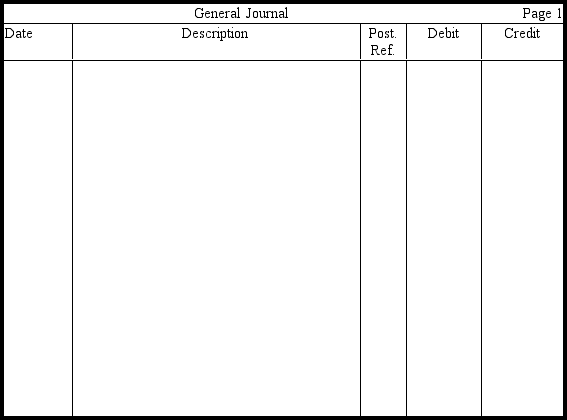

On October 1,2008,Racie's Auto Repair purchased diagnostic equipment for $13,600.The equipment had an estimated residual value of $4,000 and an eight-year life and was sold on April 1,2010.Assuming that the company depreciates the asset on a straight-line basis and reports on a calendar-year basis,journalize the following independent transactions in the journal provided.(Omit explanations.)

a. The entry to update depreciation to April 1, 2010

b. The entry to record the sale for $12,000

c. The entry to record the sale instead for $8,600

d. The entry to record the sale instead for $11,800

Correct Answer:

Verified

Q204: A truck that cost $20,000 and on

Q211: Marcus Photography purchased photographic equipment for $75,000.The

Q213: Indicate whether each of the following items

Q214: What is goodwill and when may it

Q220: In general,how does one determine whether or

Q221: Bob Quinn is in the gravel business

Q224: On November 1,2008,Rob's Auto Repair purchased diagnostic

Q226: In the journal provided,prepare entries for the

Q228: On January 2,2009,Vanowen Company purchased a

Q236: For each of the following descriptions, provide

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents