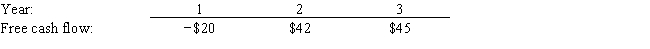

The free cash flows (in millions) shown below are forecast by Simmons Inc. If the weighted average cost of capital is 13% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3, what is the Year 0 value of operations, in millions?

A) $586

B) $617

C) $648

D) $680

E) $714

Correct Answer:

Verified

Q22: Judd Corporation has a weighted average cost

Q30: Based on the free cash flow valuation

Q31: Based on the free cash flow valuation

Q33: Huxley Building Supplies' last free cash flow

Q37: Gere Furniture forecasts a free cash flow

Q39: The free cash flows (in millions) shown

Q40: Atchley Corporation's last free cash flow was

Q43: If a firm's expected growth rate increased

Q57: A stock is expected to pay a

Q59: If a stock's dividend is expected to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents