Elan,a USCorporation,completed the December 31,2008,foreign Currency Translation of Its 70 Percent

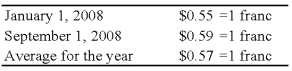

Elan,a U.S.corporation,completed the December 31,2008,foreign currency translation of its 70 percent owned Swiss subsidiary's trial balance using the current rate method.The translation resulted in a debit adjustment of $25,000.The subsidiary had reported net income of 800,000 Swiss francs for 2008 and paid dividends of 50,000 Swiss francs on September 1,2008.The translation rates for the year were:

The January 1 balance of the Investment in the Swiss subsidiary account was $1,600,000.Elan acquired its interest in the Swiss subsidiary at book value with no differential or goodwill recorded at acquisition.

-Elan's consolidated workpaper eliminations related to the foreign currency translation adjustment will include which entry?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q5: If the U.S.dollar is the currency in

Q7: Simon Company has two foreign subsidiaries.One is

Q20: The balance in Newsprint Corp.'s foreign exchange

Q21: Elan,a U.S.corporation,completed the December 31,2008,foreign currency translation

Q25: Seattle,Inc.owns an 80 percent interest in a

Q27: Dover Company owns 90% of the capital

Q28: On January 2,2008,Johnson Company acquired a 100%

Q34: Mercury Company is a subsidiary of Neptune

Q35: The assets listed below of a foreign

Q47: On January 2,20X8,Johnson Company acquired a 100%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents