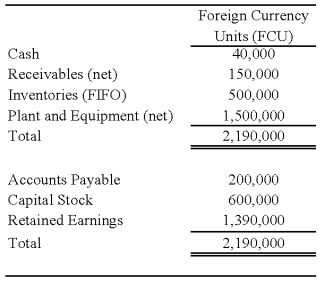

On January 2,2008,Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Perth's balance sheet contained the following information:

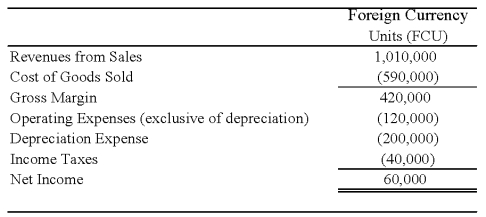

Perth's income statement for 2008 is as follows:

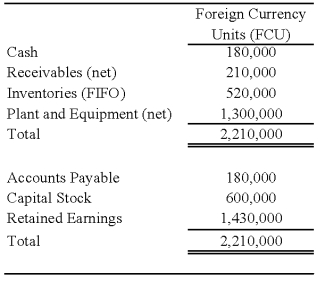

The balance sheet of Perth at December 31,2008,is as follows:

The balance sheet of Perth at December 31,2008,is as follows:

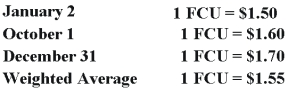

Perth declared and paid a dividend of 20,000 FCU on October 1,2008.Spot rates at various dates for 2008 follow:

Assume Perth's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 2008.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is the balance in Johnson's investment in foreign subsidiary account at December 31,2008 (assuming the use of the equity method) ?

A) $3,303,400

B) $3,294,500

C) $3,323,400

D) $3,314,500

Correct Answer:

Verified

Q22: On September 30, 20X8, Wilfred Company sold

Q37: On September 30, 20X8, Wilfred Company sold

Q41: On January 1,20X8,Pullman Corporation acquired 75 percent

Q47: On January 1,2008,Transport Corporation acquired 75 percent

Q49: Refer to the information in question 52.Assume

Q51: On January 2,2008,Johnson Company acquired a 100%

Q52: Refer to the information in question 52.Assume

Q53: On January 1,20X8,Pullman Corporation acquired 75 percent

Q55: On January 1,2008,Pace Company acquired all of

Q67: Parisian Co.is a French company located in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents