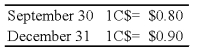

On September 30, 20X8, Wilfred Company sold inventory to Jackson Corporation, its Canadian subsidiary. The goods cost Wilfred $30,000 and were sold to Jackson for $40,000, payable in Canadian dollars. The goods are still on hand at the end of the year on December 31. The Canadian dollar (C$) is the functional currency of the Canadian subsidiary. The exchange rates follow:

-Based on the preceding information,what amount of unrealized intercompany gross profit is eliminated in preparing the consolidated financial statements for the year?

A) $0

B) $5,000

C) $10,000

D) $15,000

Correct Answer:

Verified

Q23: Park Co.'s wholly-owned subsidiary,Schnell Corp. ,maintains its

Q32: If the functional currency is the local

Q33: If the functional currency is the local

Q34: For each of the items listed below,state

Q35: On January 2, 20X8, Johnson Company acquired

Q38: Dover Company owns 90% of the capital

Q39: The Canadian subsidiary of a U.S.company reported

Q40: On January 2, 20X8, Johnson Company acquired

Q42: Mercury Company is a subsidiary of Neptune

Q53: On January 1,20X8,Pullman Corporation acquired 75 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents