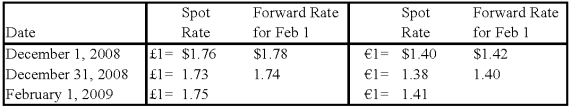

On December 1,2008,Hedge Company entered into a 60-day speculative forward contract to sell 200,000 British pounds (£) at a forward rate of £1 = $1.78.On the same day it purchased a 60-day speculative forward contract to buy 100,000 euros (€) at a forward rate of €1 = $1.42.

The rates are as follows:

Hedge had no other speculation transactions in 2008 and 2009.Ignore taxes.

-Based on the preceding information,what is the overall effect of speculation on 2008 net income?

A) $4,000 gain

B) $6,000 gain

C) $8,000 loss

D) $8,000 gain

Correct Answer:

Verified

Q17: Company X denominated a December 1,2009,purchase of

Q18: Detroit based Auto Corporation,purchased ancillaries from a

Q19: On September 3,2008,Jackson Corporation purchases goods for

Q20: On November 1,2008,Denver Company borrowed 500,000 local

Q21: On December 1,2008,Hedge Company entered into a

Q21: Myway Company sold equipment to a Canadian

Q24: Taste Bits Inc.purchased chocolates from Switzerland for

Q42: On December 1,20X8,Hedge Company entered into a

Q53: The fair market value of a near-month

Q67: Which of the following observations is true

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents