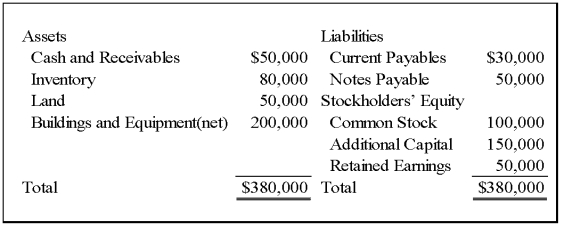

On January 1,2009,Wilton Company acquired all of Sirius Company's common shares,for $365,000 cash.On that date,Sirius's balance sheet appeared as follows:

The fair values of all of Sirius's assets and liabilities were equal to their book values except for inventory that had a fair value of $85,000,land that had a fair value of $60,000,and buildings and equipment that had a fair value of $250,000.Buildings and equipment have a remaining useful life of 10 years with zero salvage value.Wilton Company decided to employ push-down accounting for the acquisition.Subsequent to the combination,Sirius continued to operate as a separate company.

-Based on the preceding information,the write-up of buildings and equipment will:

A) increase Sirius's reported net income for 2009 by $5,000.

B) decrease Sirius's reported net income for 2009 by $5,000.

C) increase Sirius's reported net income for 2009 by $50,000.

D) have no affect on Sirius's reported net income for 2009.

Correct Answer:

Verified

Q23: On January 1,20X8,Patriot Company acquired 100 percent

Q28: On January 1,20X9,Wilton Company acquired all of

Q31: On January 1,20X8,Patriot Company acquired 100 percent

Q33: Which of the following observations is NOT

Q34: Lea Company acquired all of Tenzing Corporation's

Q35: Which of the following observations is NOT

Q36: When companies employ push-down accounting:

A)the consolidated financial

Q38: Lea Company acquired all of Tenzing Corporation's

Q49: Which term refers to the practice of

Q58: On January 1,20X9,Paradox Company acquired all of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents