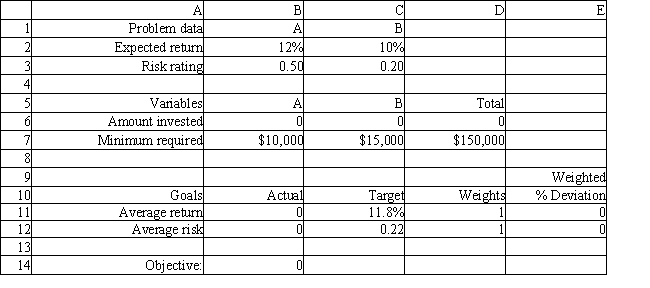

Exhibit 7.3

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B. Investment A requires a $10,000 minimum investment, pays a return of 12% and has a risk factor of .50. Investment B requires a $15,000 minimum investment, pays a return of 10% and has a risk factor of .20. The investor wants to maximize the return while minimizing the risk of the portfolio. The following minimax formulation of the problem has been solved in Excel.

-Refer to Exhibit 7.3. Which value should the investor change, and in what direction, if he wants to reduce the risk of the portfolio?

A) D11, increase

B) D12, increase

C) C12, increase

D) D12, decrease

Correct Answer:

Verified

Q18: Trade-offs in goal programming can be made

Q19: Exhibit 7.2

The following questions are based on

Q20: Exhibit 7.2

The following questions are based on

Q21: The MINIMAX objective

A) yields the smallest possible

Q22: A soft constraint

A) represents a target a

Q24: Exhibit 7.2

The following questions are based on

Q25: A constraint which cannot be violated is

Q26: Goal programming differs from linear programming or

Q27: Exhibit 7.1

The following questions are based on

Q28: Suppose that profit and human variables are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents