REFERENCE: Ref.14_03

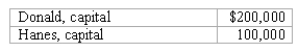

The capital account balances for Donald & Hanes LLP on January 1,2008,were as follows:  Donald and Hanes shared net income and losses in the ratio of 3:2,respectively.The partners agreed to admit May to the partnership with a 35% interest in partnership capital and net income.May invested $100,000 cash,and no goodwill was recognized.

Donald and Hanes shared net income and losses in the ratio of 3:2,respectively.The partners agreed to admit May to the partnership with a 35% interest in partnership capital and net income.May invested $100,000 cash,and no goodwill was recognized.

-Which of the following could be used as a basis to allocate profits among partners who are active in the management of the partnership?

1) allocation of salaries.

2) the number of years with the partnership.

3) the amount of time each partner works.

4) the average capital invested.

A) 1 and 2.

B) 1 and 3.

C) 1,2,and 3.

D) 1,3,and 4.

E) 1,2,3,and 4.

Correct Answer:

Verified

Q44: REFERENCE: Ref.14_05

Donald,Anne,and Todd have the following capital

Q45: What is the balance of May's capital

Q46: Max,Jones and Waters shared profits and losses

Q48: REFERENCE: Ref.14_05

Donald,Anne,and Todd have the following capital

Q49: REFERENCE: Ref.14_05

Donald,Anne,and Todd have the following capital

Q54: The capital account balances for Donald

Q79: What is the dissolution of a partnership?

Q84: Why are the terms of the Articles

Q88: Brown and Green are forming a business

Q89: For what events or conditions should the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents