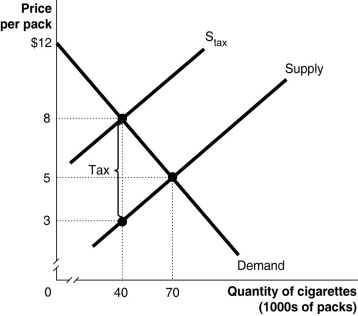

Figure 4-18  Figure 4-18 shows the market for cigarettes. The government plans to impose a per-unit tax in this market.

Figure 4-18 shows the market for cigarettes. The government plans to impose a per-unit tax in this market.

-Refer to Figure 4-18. As a result of the tax, is there a loss in producer surplus?

A) Yes, because producers are not selling as many units now.

B) No, because the consumer pays the tax.

C) No, because the market reaches a new equilibrium.

D) No, because producers are able to raise the price to cover their tax burden.

Correct Answer:

Verified

Q163: A tax is imposed on employers and

Q163: Article Summary

Voters in California approved a $2

Q170: The government proposes a tax on halogen

Q178: Suppose an excise tax of $0.75 is

Q179: When the government taxes a good or

Q181: If a tax is imposed on a

Q189: In the market for gasoline,an increase in

Q189: One result of a tax is an

Q200: The incidence of a tax depends on

Q358: Figure 4-18 ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents