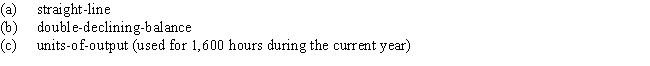

Machinery is purchased on July 1 of the current fiscal year for $240,000.It is expected to have a useful life of 4 years,or 25,000 operating hours,and a residual value of $15,000.Compute the depreciation for the last six months of the current fiscal year ending December 31 by each of the following methods:

Correct Answer:

Verified

Q155: Solare Company acquired mineral rights for $60,000,000.The

Q156: For each of the following fixed assets,determine

Q157: Equipment purchased at the beginning of the

Q158: Equipment costing $80,000 with a useful life

Q159: Convert each of the following estimates of

Q161: Equipment acquired at a cost of $126,000

Q162: Fill in the missing numbers using the

Q164: Carter Co.acquired drilling rights for $18,550,000.The oil

Q213: On December 31, Bowman Company estimated that

Q222: On October 1, Sebastian Company acquired new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents