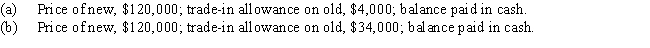

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $55,000 (including depreciation for the current year to date)is exchanged for similar machinery.Assume that the transaction has commercial substance.For financial reporting purposes,present entries to record the exchange of the machinery under each of the following assumptions:

Correct Answer:

Verified

Q164: Carter Co.acquired drilling rights for $18,550,000.The oil

Q166: On the first day of the fiscal

Q167: On July 1,Sterns Co.acquired patent rights for

Q169: Equipment was acquired at the beginning of

Q170: The following information was taken from a

Q171: Equipment acquired on January 2,Year 1,at a

Q172: Identify the following as a fixed asset

Q173: Chasteen Company acquired mineral rights for $9,100,000.The

Q213: On December 31, Bowman Company estimated that

Q222: On October 1, Sebastian Company acquired new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents