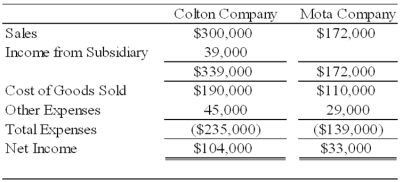

44.Colton Company acquired 80 percent ownership of Mota Company's voting shares on January 1,2008,at underlying book value.The fair value of the noncontrolling interest on that date was equal to 20 percent of the book value of Mota Company.During 2008,Colton purchased inventory for $30,000 and sold the full amount to Mota Company for $50,000.On December 31,2008,Mota's ending inventory included $10,000 of items purchased from Colton.Also in 2008,Mota purchased inventory for $80,000 and sold the units to Colton for $100,000.Colton included $30,000 of its purchase from Mota in ending inventory on December 31,2008.Summary income statement data for the two companies revealed the following:

Required:

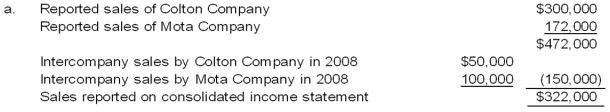

a.Compute the amount to be reported as sales in the 20X8 consolidated income statement.

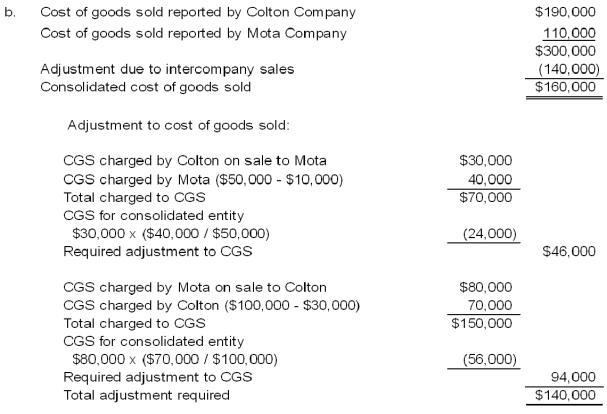

b.Compute the amount to be reported as cost of goods sold in the 20X8 consolidated income statement.

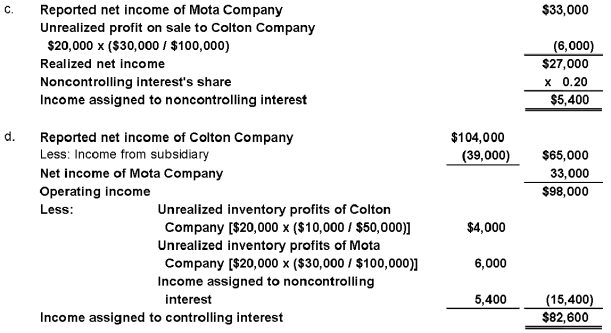

c.What amount of income will be assigned to the noncontrolling shareholders in the 20X8 consolidated income statement?

d.What amount of income will be assigned to the controlling interest in the 20X8 consolidated income statement?

Answer:

Answer:

Alternative solution: d

Alternative solution: d

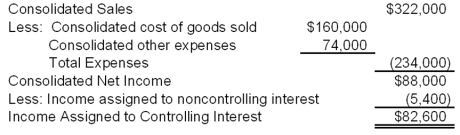

Information on consolidated sales was computed in part (a);consolidated cost of goods sold was computed in part (b)and income assigned to the noncontrolling interest was computed in part (c).

Learning Objective: 06-04 Prepare equity-method journal entries and elimination entries for the consolidation of a subsidiary following upstream inventory transfers.

Learning Objective: 06-04 Prepare equity-method journal entries and elimination entries for the consolidation of a subsidiary following upstream inventory transfers.

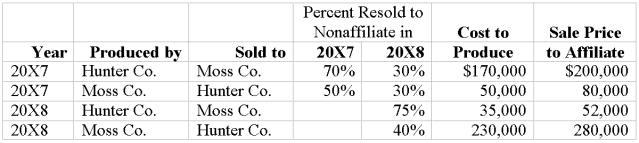

-Hunter Company and Moss Company both produce and purchase fabric for resale each period and frequently sell to each other.Since Hunter Company holds 80 percent ownership of Moss Company,Hunter's controller compiled the following information with regard to intercompany transactions between the two companies in 20X7 and 20X8:

Required:

a.Give the eliminating entries required at December 31,20X8,to eliminate the effects of the inventory transfers in preparing a full set of consolidated financial statements.

b.Compute the amount of cost of goods sold to be reported in the consolidated income statement for 20X8.

Correct Answer:

Verified

Q36: Pilfer Company acquired 90 percent ownership of

Q41: On January 1,20X7,Jones Company acquired 90 percent

Q42: Pisa Company acquired 75 percent of Siena

Q43: On January 1,20X7,Jones Company acquired 90 percent

Q46: On January 1,20X7,Jones Company acquired 90 percent

Q47: Pisa Company acquired 75 percent of Siena

Q55: Elvis Company purchases inventory for $70,000 on

Q58: Parent Corporation owns 90 percent of Subsidiary

Q59: Padre Company purchases inventory for $70,000 on

Q60: Padre Company purchases inventory for $70,000 on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents