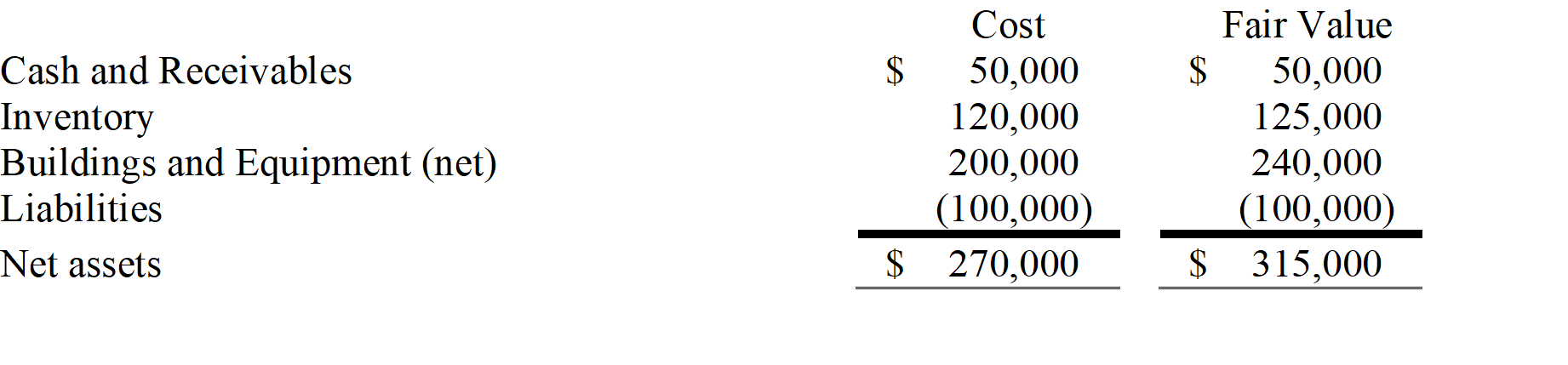

On July 1,20X9,Playa Corporation paid $340,000 for all of Seashore Company's outstanding common stock.On that date,the costs and fair values of Seashore's recorded assets and liabilities were as follows:

-Based on the preceding information,what amount should be allocated to goodwill in the consolidated balance sheet,prepared after this business combination?

A) $0

B) $25,000

C) $70,000

D) $45,000

Correct Answer:

Verified

Q4: Tanner Company,a subsidiary acquired for cash,owned equipment

Q5: Pace Corporation acquired 100 percent of Spin

Q6: On October 1,20X3,Pole Corporation paid $450,000 for

Q7: On December 31,20X9,Pluto Company acquired 100 percent

Q8: Paccu Corporation acquired 100 percent of Sallee

Q10: On December 31,20X9,Pluto Company acquired 100 percent

Q11: Pace Corporation acquired 100 percent of Spin

Q12: Paccu Corporation acquired 100 percent of Sallee

Q13: Pace Corporation acquired 100 percent of Spin

Q14: Pace Corporation acquired 100 percent of Spin

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents