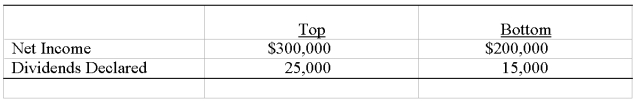

Top Company obtained 100 percent of Bottom Company's common stock on January 1,20X6 by issuing 12,500 shares of its own common stock,which had a $5 par value and a $15 fair value on that date.Bottom reported a net book value of $150,000 and its shares had a $20 per share fair value on that date.However,some of its plant assets (with a 5-year remaining life)were undervalued by $20,000 in the company's accounting records.Bottom had also developed a customer list with an estimated fair value of $10,000 and a remaining life of 10 years.Top Company uses the equity-method to account for its investment in Bottom.During 20X6 Top and Bottom reported the following:

Required:

Prepare each of the journal entries listed below related to Top's investment in Bottom.

1.Top's acquisition of Bottom.

2.Top's share of Bottom's 20X6 income.

3.Top's share of Bottom's 20X6 dividend income.

4.Top's amortization of excess acquisition price.

Correct Answer:

Verified

Q30: On January 1,20X8,Patriot Company acquired 100 percent

Q33: On December 31,20X8,Polaris Corporation acquired 100 percent

Q41: Silver Corporation acquired 100 percent of Bronze

Q43: On December 31,20X9,Thessaly Corporation acquired all of

Q44: Dish Corporation acquired 100 percent of the

Q45: Which of the following is true? When

Q46: Paco Company acquired 100 percent of the

Q47: Lea Company acquired all of Tenzing Corporation's

Q48: Plant Company acquired all of Sprout Corporation's

Q56: Plant Company acquired all of Sprout Corporation's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents