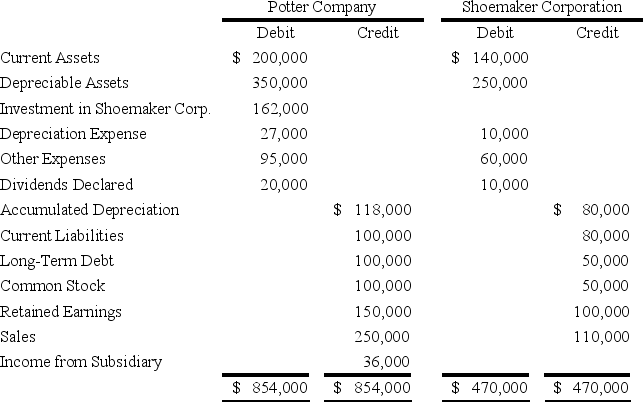

On January 1,20X8,Potter Corporation acquired 90 percent of Shoemaker Company's voting stock,at underlying book value.The fair value of the noncontrolling interest was equal to 10 percent of the book value of Shoemaker at that date.Potter uses the fully adjusted equity method in accounting for its ownership of Shoemaker.On December 31,20X9,the trial balances of the two companies are as follows:

-Based on the preceding information,what amount would be reported as retained earnings in the consolidated balance sheet prepared at December 31,20X9?

A) $314,000

B) $294,000

C) $150,000

D) $424,000

Correct Answer:

Verified

Q29: Pluto Company owns 80 percent of the

Q30: ASC 805 is related to the Consolidation

Q31: In reading a set of consolidated financial

Q32: Princeton Company acquired 75 percent of the

Q33: Which of the following usually does not

Q34: All of the following statements accurately describe

Q36: Primo Corporation acquired 60 percent of Secondo

Q37: On January 1,20X5,Playa Company acquires 90 percent

Q38: On December 31,20X9,Play Company acquired 80 percent

Q39: On January 1,20X9,Pallet Company acquires 80 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents