Speedy Machine Products manufactures its products in two separate departments, Machining and Painting. Total manufacturing overhead costs for the year are budgeted at $2,500,000. Of this amount the Machining Department incurs $1,500,000 (primarily for machine operation and depreciation) while the Painting Department incurs $1,000,000. Speedy Machine Products estimates that it will incur 12,000 machines hours (all in the Milling Department) and 40,000 direct labour hours (15,000 in the Milling Department and 25,000 in the Assembly Department) during the year.

Speedy Machine Products currently uses a plantwide overhead rate based on direct labour hours to allocate overhead. However, the company is considering refining its overhead allocation system by using departmental overhead rates. The Machining Department would allocate its overhead using machine hours (MH), but the Painting Department would allocate its overhead using direct labour (DL) hours.

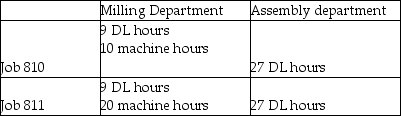

The following chart shows the machine hours (MH) and direct labour (DL) hours incurred by Jobs 810 and 811 in each production department:

Both Jobs 810 and 811 used $7,500 of direct materials. Wages and benefits total $30 per direct labour hour. Speedy Machine Products prices its products at 120% of total manufacturing costs.

Required:

1. Compute Speedy Machine Products' current plantwide overhead rate.

2. Compute refined departmental overhead rates.

3. Compute the total amount of overhead allocated to each job if Speedy Machine Products uses its current plantwide overhead rate.

4. Compute the total amount of overhead allocated to each job if Speedy Machine Products uses departmental overhead rates.

5. Do both allocation systems accurately reflect the resources that each job used? Explain.

6. Compute the total manufacturing cost and sales price of each job using Speedy Machine Products' current plantwide overhead rate.

7. Compute the total manufacturing cost and sales price of each job using Speedy Machine Products' refined departmental overhead rates

8. Based on the current (plantwide) allocation system, how much profit did Speedy Machine Products think it earned on each job?

9.Based on the departmental overhead rates and the sales price determined in Requirement 7, how much profit did it really earn on each job?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Facility-level activities and costs are incurred no

Q52: The cost of inspecting and packaging each

Q53: Murphy's Machine Works manufactures custom equipment. Sector's

Q54: It is easier to allocate indirect costs

Q55: Unit-level activities and costs are incurred once

Q56: Sector's Machine Works manufactures custom equipment. Sector's

Q60: Two main benefits of ABC are (1)more

Q60: Batch-level activities and costs are incurred again

Q61: Machine set-up would most likely be classified

Q62: What is the last step in developing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents