Kiji.ca is an internet advertising agency. The firm uses a job cost system in which each client is a different "job." Kiji.ca traces direct labour, software licensing costs, and travel costs directly to each client (job). The company allocates the indirect costs to jobs based on a predetermined indirect cost allocation rate based on direct labour hours.

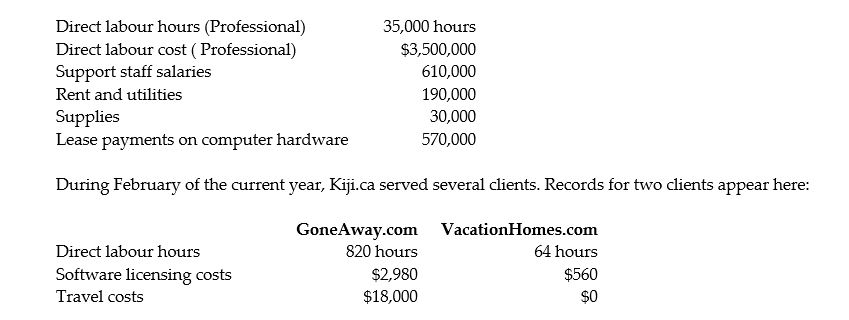

At the beginning of the current year, managing partner, Sylvia Long prepared a budget:

Requirements:

1. Compute Kiji.ca's predetermined indirect cost allocation rate for the current year based on direct labour hours.

2. Compute the total cost on each job.

3. If Kiji.ca wants to earn profits equal to 20% of total cost, then how much (what total fee) should it charge each of these clients?

Correct Answer:

Verified

Q343: The law firm of Lyons & Lyons

Q344: An interior designer spends 30 hours working

Q345: The hourly price charged to clients for

Q346: Tellit.ca is an internet advertising agency. The

Q347: An interior designer spends 35 hours working

Q348: Carlson Computing Services expects its computer technicians

Q349: When job costing is used as a

Q351: The engineering firm of Timothy & Greene

Q352: Coopers & Stocker Consulting pays Kelly Yoster

Q353: The journal entries needed for job costing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents