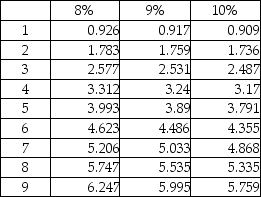

Tampa Corporation is considering an investment proposal that will require an initial outlay of $820,000 and would yield yearly cash inflows of $216,000 for nine years.The company uses a discount rate of 10%.What is the NPV of the investment?

Present value of an ordinary annuity of $1:

A) $378,000

B) $410,000

C) $423,944

D) $251,667

Correct Answer:

Verified

Q93: The net present value method of evaluating

Q98: When computing the present value,the interest rate

Q102: Which of the following situations suggests the

Q103: Gamma Corporation is considering an investment of

Q104: A company is considering an iron ore

Q105: An opportunity cost is the benefit foregone

Q106: The following information is provided by Glinda

Q110: When comparing several investments with the same

Q115: Under conditions of limited resources,when a company

Q118: An investment should be accepted if _.

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents