Peri Corporation is considering an investment opportunity with the following expected net cash inflows: Year 1,$260,000;Year 2,$340,000;Year 3,$390,000.The company uses a discount rate of 11%,and the initial cost of the investment is $770,000.

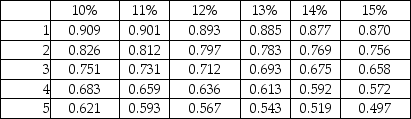

Present Value of $1:

The IRR of the project will be ________.

A) less than 11%

B) between 11% and 12%

C) between 12% and 13%

D) more than 11%

Correct Answer:

Verified

Q123: At the internal rate of return,the present

Q126: When the internal rate of return is

Q127: Provide responses to the following questions regarding

Q128: A company is considering an iron ore

Q130: The following information is provided by Dinovo

Q131: Gregory Cable Company is considering investing $450,000

Q132: Candela Cable Company is considering investing $450,000

Q140: Which of the following is the rate

Q142: Many service,merchandising,and manufacturing firms use discounted cash

Q144: The discounted cash flow methods of evaluating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents