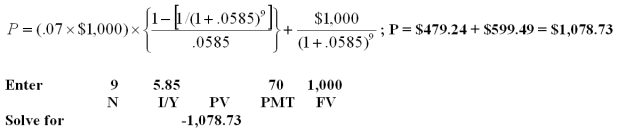

Guggenheim,Inc.offers a 7% coupon bond with annual payments.The yield to maturity is 5.85% and the maturity date is 9 years.What is the market price of a $1,000 face value bond?

A) $742.66

B) $868.67

C) $869.67

D) $1,078.73

E) $1,079.59

Correct Answer:

Verified

Q26: The total interest paid on a zero-coupon

Q27: The yield to maturity is:

A)the rate that

Q28: Chocolate and Rum,Inc.offers a 7% coupon bond

Q29: The Lo Sun Corporation offers a 6%

Q29: The Fisher formula is expressed as _

Q30: A Corporate bond has an 8% coupon

Q31: The value of a 25 year zero-coupon

Q34: Moonhigh,Inc.has a 5%,semiannual coupon bond with a

Q34: Face value is:

A)always higher than current price.

B)always

Q36: Consider a bond which pays 8% semiannually

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents