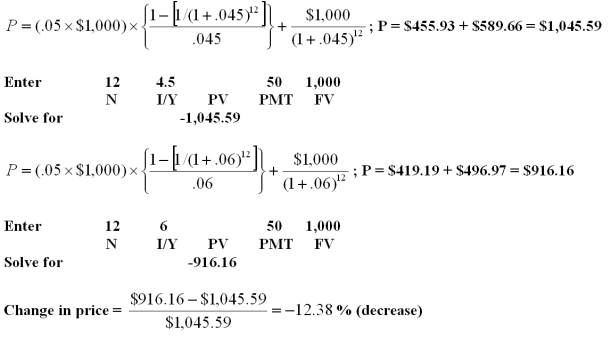

A 12-year,5% coupon bond pays interest annually.The bond has a face value of $1,000.What is the change in the price of this bond if the market yield rises to 6% from the current yield of 4.5%?

A) 11.11% decrease

B) 12.38% decrease

C) 12.38% increase

D) 14.13% decrease

E) 14.13% increase

Correct Answer:

Verified

Q41: A bond that pays interest annually yields

Q42: The nominal rate of return on the

Q43: The outstanding bonds of Boutelle,Inc. provide a

Q45: Which of the following amounts is closest

Q47: The bonds of Jerrod's Welding,Inc. pay an

Q48: The MerryWeather Firm wants to raise $10

Q48: A corporate bond is quoted at a

Q52: Ted's Co.offers a zero coupon bond with

Q53: A zero coupon bond with a face

Q62: Calculate the YTM on a bond priced

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents