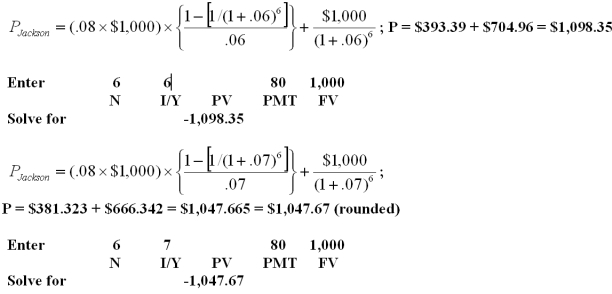

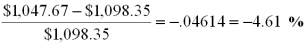

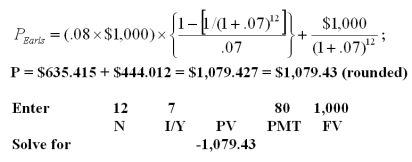

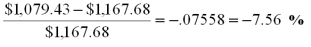

Jackson Central has a 6-year,8% annual coupon bond with a $1,000 par value.Earls Enterprises has a 12-year,8% annual coupon bond with a $1,000 par value.Both bonds currently have a yield to maturity of 6%.Which of the following statements are correct if the market yield increases to 7%?

A) Both bonds would decrease in value by 4.61%.

B) The Earls bond will increase in value by $88.25.

C) The Jackson bond will increase in value by 4.61%.

D) The Earls bond will decrease in value by 7.56%.

E) The Earls bond will decrease in value by $50.68.

Correct Answer:

Verified

Q43: The outstanding bonds of Boutelle,Inc. provide a

Q45: Which of the following amounts is closest

Q48: A corporate bond is quoted at a

Q54: A corporate bond with a face value

Q58: Moonhigh,Inc. has a 6%,semiannual coupon bond with

Q58: Given the opportunity to invest in

Q63: Sometimes it is not clear if a

Q66: Define what is meant by interest rate

Q67: The discussion of asset pricing in the

Q87: Why do corporations issue 100-year bonds,knowing that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents