Dennis Corporation entered into a long-term lease for a piece of equipment. The lease term calls for an annual payment of $2,000 for six years, which approximates the useful life of the equipment. Assume a discount factor of 16 percent. (Note: Present value of a single sum factor at six years and 16% is 0.410; present value of an annuity factor at six years and 16% is 3.685.) Round answers to the nearest dollar.

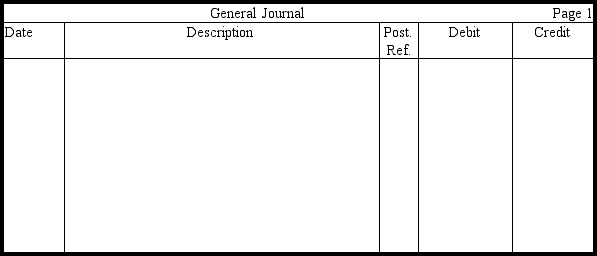

a. Prepare the entry without explanation to record the leased equipment.

b. Prepare the entry without explanation to record annual depreciation, assuming the straight-line method and no residual value.

c. Prepare the entry without explanation to record the first annual payment of $2,000, after the company has had the equipment for one year.

Correct Answer:

Verified

Q135: When the straight-line method of amortization is

Q150: When bonds are converted to common stock,which

Q156: If $112,000 of 12 percent bonds are

Q157: If bonds payable were issued initially at

Q162: Alby Corporation purchased a warehouse by signing

Q164: On January 1, 2009, Woodvale Corporation issued

Q166: Fiona Corporation has a 7 percent, $600,000

Q177: Bonds that contain a provision that allows

Q184: When fixed mortgage payments are made,in what

Q189: When a bond sells at a premium,what

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents