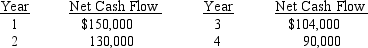

A $350,000 capital investment proposal has an estimated life of four years and no residual value.The estimated net cash flows are as follows:

The minimum desired rate of return for net present value analysis is 12%.The present value of $1 at compound interest of 12% for 1,2,3,and 4 years is .893,.797,.712,and .636,respectively.Determine the net present value.

Correct Answer:

Verified

Q90: June Co.is evaluating a project requiring a

Q91: All of the following qualitative considerations may

Q93: Using the following partial table of present

Q96: The rate of earnings is 10% and

Q100: In capital rationing, an initial screening of

Q100: Proposals M and N each cost $800,000,have

Q108: A 5-year project is estimated to cost

Q129: Assume in analyzing alternative proposals that Proposal

Q129: Periods in time that experience increasing price

Q152: The process by which management allocates available

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents