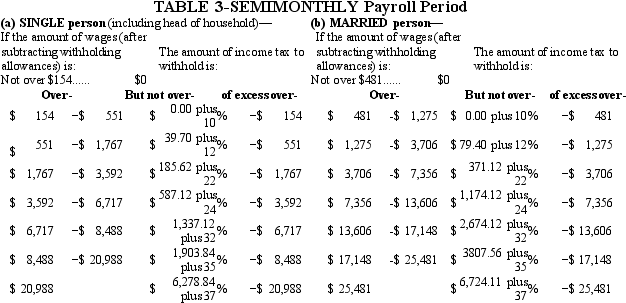

Danny is a full-time exempt employee in Alabama,where the state income tax rate is 5%.He earns $78,650 annually and is paid semimonthly.He is married with four withholding allowances.His health insurance is $100.00 per pay period and is deducted on a pre-tax basis.Danny contributes 5% of his pay to his 401(k) .Assuming that he has no other deductions,what is Danny's net pay for the period? (Use the percentage method for the federal income tax and the wage-bracket table for the state income tax.Do not round intermediate calculations.Round your final answer to 2 decimal places. )

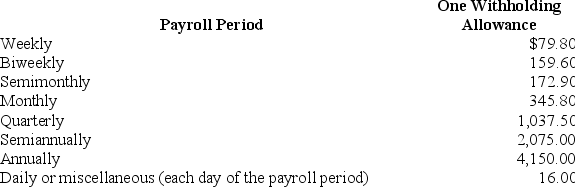

Table 5.Percentage Method-2018 Amount for one Withholding Allowance

A) $2,245.53

B) $2,403.95

C) $2,414.53

D) $2,178.90

Correct Answer:

Verified

Q37: Natalia is a full-time exempt employee who

Q38: Julio is single with 1 withholding allowance.He

Q39: Max earned $1,019.55 during the most recent

Q40: Trish earned $1,734.90 during the most recent

Q43: Maile is a full-time exempt employee in

Q44: Why do employers use checks as an

Q45: Which of the following payment methods is

Q47: Collin is a full-time exempt employee in

Q48: What is an advantage of direct deposit

Q59: Which body issued Regulation E to protect

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents