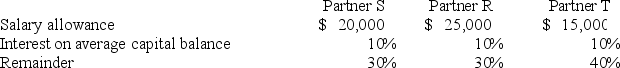

The SRT partnership agreement specifies that partnership net income be allocated as follows:

Average capital balances for the current year were $60,000 for S,$50,000 for R,and $40,000 for T.

Average capital balances for the current year were $60,000 for S,$50,000 for R,and $40,000 for T.

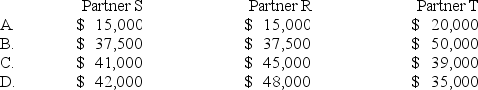

-Refer to the information given.Assuming a current year net income of $125,000,what amount should be allocated to each partner?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q1: Shue,a partner in the Financial Brokers Partnership,has

Q3: The SRT partnership agreement specifies that partnership

Q4: When a partnership is formed,noncash assets contributed

Q5: RD formed a partnership on February 10,20X9.R

Q6: The terms of a partnership agreement provide

Q7: The APB partnership agreement specifies that partnership

Q8: Which of the following accounts could be

Q9: Which of the following accounts could be

Q10: The terms of a partnership agreement provide

Q11: Which of the following statements best describes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents