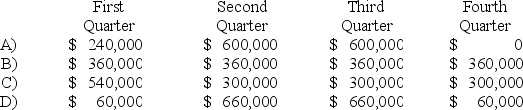

Mason Company paid its annual property taxes of $240,000 on February 15,20X9.Mason also anticipates that its annual repairs expense for 20X9 will be $1,200,000.This amount is usually incurred and paid in July and August when operations are shut down so that machinery and equipment can be repaired.What amount should Mason deduct for property taxes and repairs in each quarter for 20X9?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q54: Davis Company uses LIFO for all of

Q55: How would a company report a change

Q56: Missoula Corporation disposed of one of its

Q57: Which of the following observations is true

Q58: Lloyd Corporation reports the following information for

Q60: Tyler Company incurred an inventory loss due

Q61: Interim income statements are required for Smith

Q62: The information below is for the second

Q63: FASB has specified a "75% percent consolidated

Q64: Ridge Company is in the process of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents