On January 2,20X8,Polaris Company acquired a 100% interest in the capital stock of Ski Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Ski's balance sheet contained the following information:

Ski's income statement for 20X8 is as follows:

Ski's income statement for 20X8 is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

The balance sheet of Ski at December 31,20X8,is as follows:

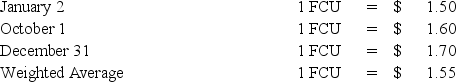

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Ski declared and paid a dividend of 20,000 FCU on October 1,20X8.Spot rates at various dates for 20X8 follow:

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

Assume Ski's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 20X8.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is Ski's net income for 20X8 in U.S.dollars (include the remeasurement gain or loss in Ski's net income) ?

A) $238,000

B) $228,000

C) $219,500

D) $202,000

Correct Answer:

Verified

Q55: On January 1,20X8,Pullman Corporation acquired 75 percent

Q56: South Company is a subsidiary of Pole

Q57: Michigan-based Leo Corporation acquired 100 percent of

Q58: Which combination of accounts and exchange rates

Q59: The British subsidiary of a U.S.company reported

Q61: Which of the following describes a situation

Q62: Briefly explain the following terms associated with

Q63: Prepare a schedule providing a proof of

Q64: The gain or loss on the effective

Q65: On January 1,20X8,Pace Company acquired all of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents