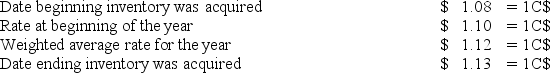

The Canadian subsidiary of a U.S.company reported cost of goods sold of 50,000 C$,for the current year ended December 31.The beginning inventory was 15,000 C$,and the ending inventory was 10,000 C$.Spot rates for various dates are as follows:

Assuming the U.S.dollar is the functional currency of the Canadian subsidiary,the remeasured amount of cost of goods sold that should appear in the consolidated income statement is

A) $50,000.

B) $55,300.

C) $56,000.

D) $56,500.

Correct Answer:

Verified

Q45: On January 2,20X8,Polaris Company acquired a 100%

Q46: Elan,a U.S.corporation,completed the December 31,20X8,foreign currency translation

Q47: Michigan-based Leo Corporation acquired 100 percent of

Q48: On January 2,20X8,Polaris Company acquired a 100%

Q49: Stack Company is a subsidiary of Pile

Q51: On January 1,20X8,Pullman Corporation acquired 75 percent

Q52: Michigan-based Leo Corporation acquired 100 percent of

Q53: On January 1,20X8,Pullman Corporation acquired 75 percent

Q54: Michigan-based Leo Corporation acquired 100 percent of

Q55: On January 1,20X8,Pullman Corporation acquired 75 percent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents