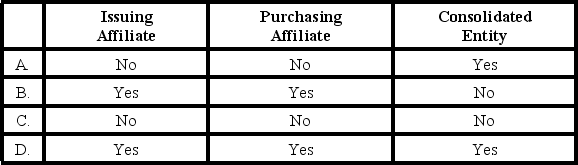

When one company purchases the debt of an affiliate from an unrelated party,a gain or loss on the constructive retirement of debt is recognized by which of the following?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q11: Puget Corporation owns 80 percent of Sound

Q12: Spice Company issued $200,000 of 10 percent

Q14: On January 1,20X6,Pepper Corporation issued 10-year bonds

Q17: Saturn Corporation issued $300,000 par value 10-year

Q18: Puget Corporation owns 80 percent of Sound

Q19: Pancake Corporation owns 85 percent of Syrup

Q19: Which of the following statements is (are)correct?

I.The

Q21: Sydney Company issued $1,000,000 par value 10-year

Q24: Postage,a holder of a $400,000 Stamp Inc.bond,collected

Q29: Postage,a holder of a $400,000 Stamp Inc.bond,collected

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents