Nexus Star Inc.produces various kinds of oils.One of its product,Product X,is made from castor oil,beeswax,aloe vera,and a base compound.

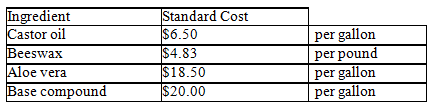

For the next 12 months,the company's purchasing agent believes that the cost of ingredients will be as follows:

The direct labor time standard is 3.50 hours per unit at a standard direct labor rate of $12.00 per hour.The standard overhead rates are $15.00 per direct labor hour for the standard variable overhead rate and $13.00 per direct labor hour for the standard fixed overhead rate.

a.Using these production standards,compute the standard unit cost of direct materials per unit if it takes 0.50 gallon of castor oil,1 pound of beeswax,0.25 gallon of aloe vera,and 1 gallon of base compound to produce one unit of product X.Round values to two decimal places.

b.Using the standard unit cost of direct materials per case determined in (a)and the production standards given for direct labor and overhead,compute the standard unit cost of one unit of product X.

Correct Answer:

Verified

Q102: Outdoors Inc.manufactures steel hitches for camping trailers.The

Q103: Keerin Inc. ,produces a complete line of

Q103: Golf Pro Inc.makes wood drivers for the

Q104: Fantastic Lips Inc.specializes in manufacturing lipstick.Racy Red,one

Q111: The Silent Door Company manufactures soundproof doors.Each

Q111: Powerhorse Inc.manufactures steel hitches for horse trailers.The

Q113: The effective evaluation of managers' performance depends

Q114: Mention a few reasons for an unfavorable

Q116: "A favorable direct materials price variance is

Q119: Differentiate between the variable overhead spending variance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents