A taxpayer just changed jobs and incurred unreimbursed moving expenses.

Correct Answer:

Verified

Q108: Once set for a year, when might

Q113: How are combined business/pleasure trips treated for

Q125: In terms of income tax treatment, what

Q127: If a business retains someone to provide

Q128: For the current football season,Rail Corporation pays

Q133: Brian makes gifts as follows:

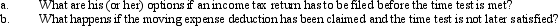

Q134: Concerning the deduction for moving expenses, what

Q134: What originally led to the cutback adjustment?

Q135: Rocky has a full-time job as an

Q136: In the current year,Bo accepted employment with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents