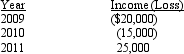

Samantha invested $75,000 in a passive activity several years ago,and on January 1,2009,her amount at risk was $15,000.Her shares of the income and losses in the activity for the next three years are as follows:

How much can Samantha deduct in 2009 and 2010? What is her taxable income from the activity in 2011? (Consider both the at-risk rules as well as the passive loss rules. )

How much can Samantha deduct in 2009 and 2010? What is her taxable income from the activity in 2011? (Consider both the at-risk rules as well as the passive loss rules. )

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: During the current year,Ryan performs personal services

Q88: When a taxpayer disposes of a passive

Q89: Orange Corporation,a closely held (non-personal service)C corporation,earns

Q90: Ken has a $40,000 loss from an

Q91: Barb borrowed $100,000 to acquire a parcel

Q92: Faye dies owning an interest in a

Q93: What special passive loss treatment is available

Q101: Purple Corporation, a personal service corporation, earns

Q111: Pat sells a passive activity for $100,000

Q114: Vail owns interests in a beauty salon,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents