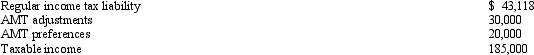

Robin,who is a head of household and age 42,provides you with the following information from his financial records for 2010.  Calculate his AMT for 2010.

Calculate his AMT for 2010.

A) $13,922.

B) $14,810.

C) $191,871.

D) $219,425.

E) None of the above.

Correct Answer:

Verified

Q69: Prior to the effect of tax credits,Eunice's

Q70: Wallace owns a construction company that builds

Q71: Erin owns a mineral property that had

Q72: In 2010,Glenda had a $97,000 loss on

Q73: Factors that can cause the adjusted basis

Q75: Akeem,who does not itemize,incurred a net operating

Q76: Which of the following statements is correct?

A)The

Q77: Which of the following can produce an

Q78: Celia and Amos,who are married filing jointly,have

Q79: Kevin's AGI is $285,000.He contributed $150,000 in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents